per capita tax meaning

Under a per capita distribution each. Well income per capita is basically the amount of money per person in a specific area.

Per Capita Definition Formula Examples And Limitations Boycewire

Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year.

. The GNI per capita is the dollar value of a countrys final income in a year divided by its population. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. It can apply to the average per-person income for a city region or country and is.

What is the Per Capita Tax. Per Capita Payment means a distribution from the Nation to a member of the Ho-Chunk Nation made pursuant to the Nations Per Capita Distribution Ordinance 2 HCC 12. For example a common way in which per capita is used is.

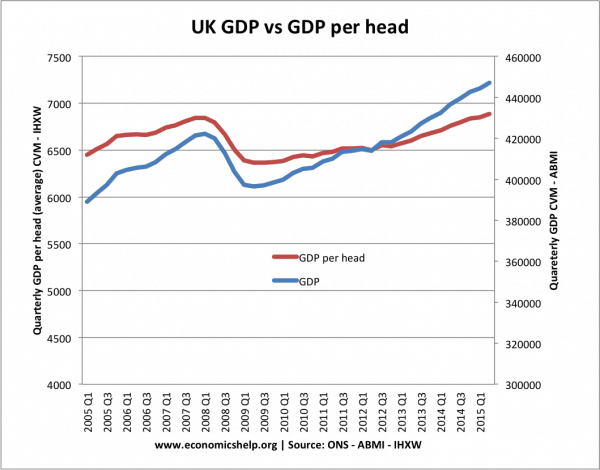

The definition of GDP per capita is when the GDP is divided by the countrys population to show the national breakdown of a countrys economic output in relation to its. Real Estate taxes are listed in the Mortgage Interest or Property Real Estate section of Deductions. Should a beneficiary die these remain in effect.

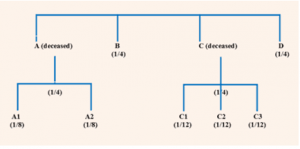

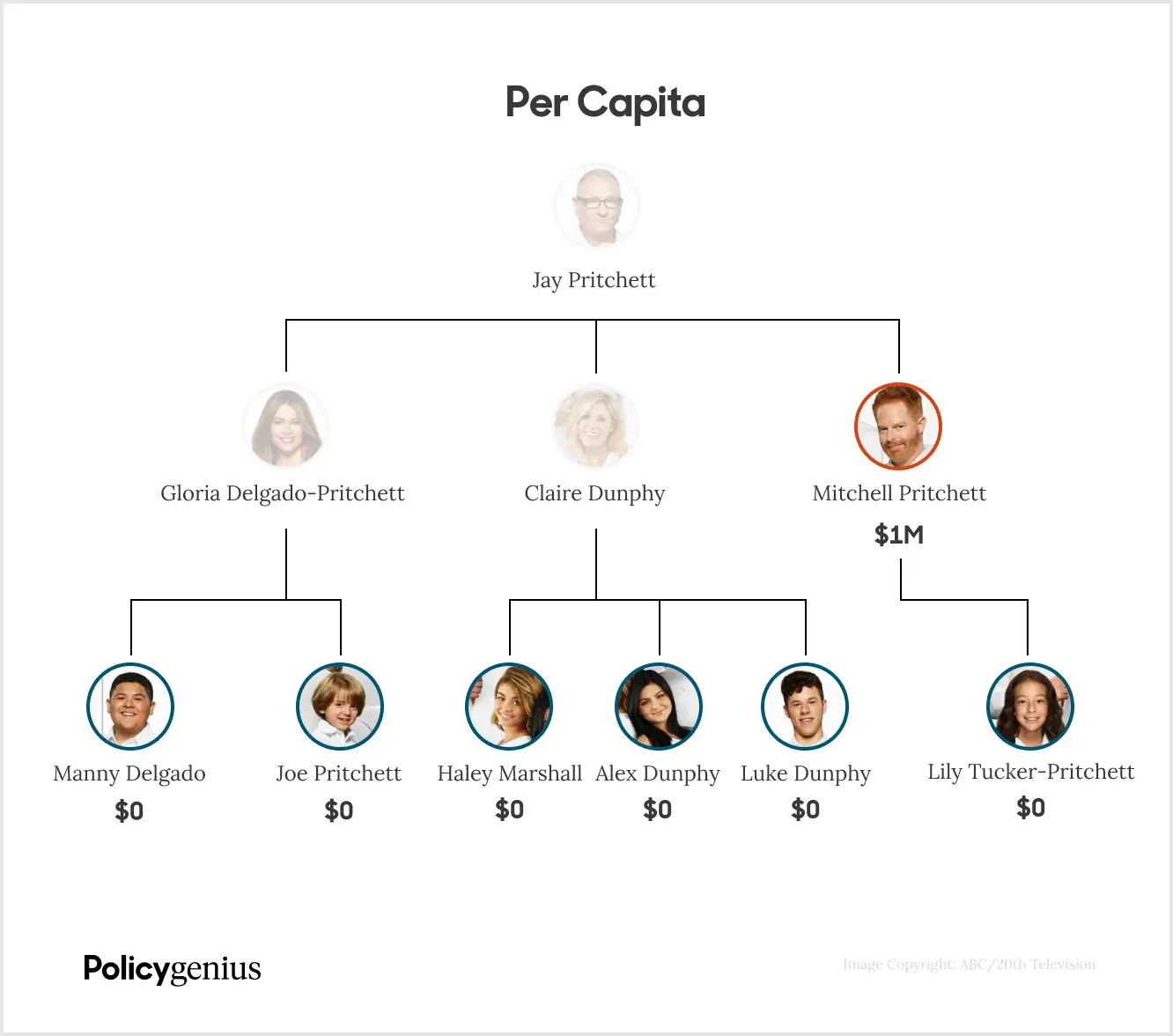

Per capita distributions could trigger generation-skipping tax for grandchildren or other descendants who inherit part of your estate. The school district as well as the township or borough in which you reside may levy a per capita tax. It means to share and share alike according to the number of.

Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period. By or for each individual a high per capita tax burden.

Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Become null and void should the beneficiary die. It is calculated by dividing the areas. Income per capita is a measure of the amount of money earned per person in a certain area.

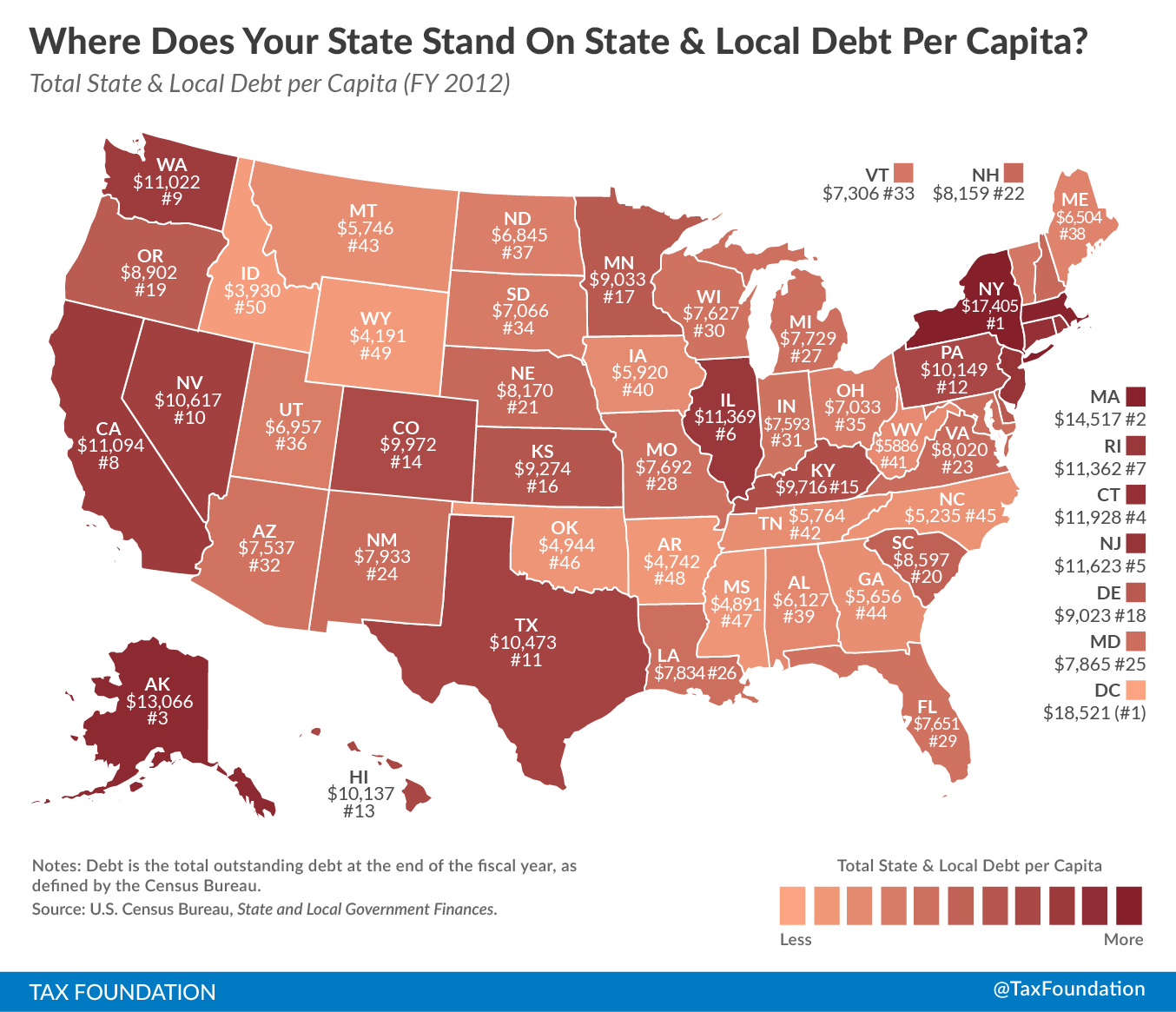

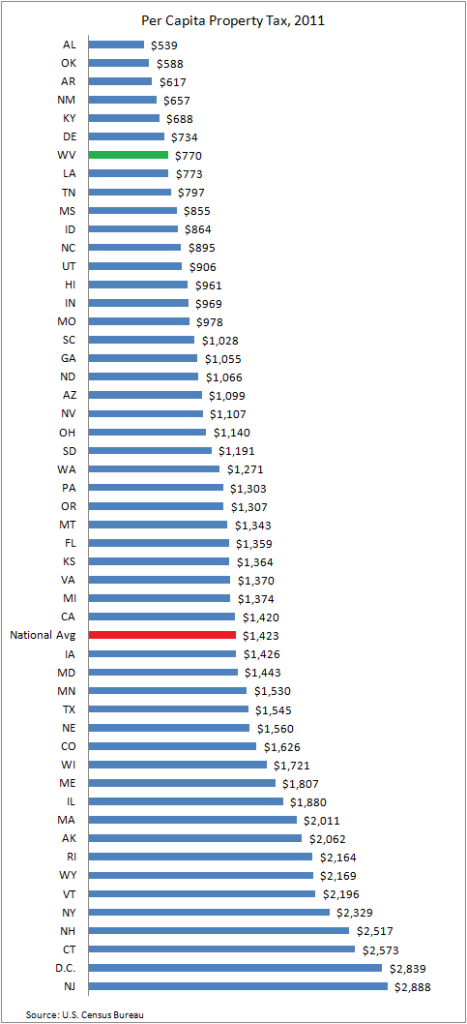

On average state and local governments collected 1556 per capita in property taxes nationwide in FY 2016 but collections vary widely from state to state. In these days of diminishing resources and tight budgets the Presbyterian Church USA continues to seek new and innovative ways to provide ministry and support to mid. Do I pay this tax if I.

Per Capita Tax. It is not dependent upon employment. More specifically according to the United States Census Bureau it is the money earned.

Per Capita means by head so this tax is commonly called a head tax. It should be reflecting the average before tax income of a countrys citizens. What is a Per Capita tax.

This was a function of both rate. Both taxes are due each year and are not duplications. Per unit of population.

On average state and local governments collected 1303 per capita in individual income taxes but collections varied widely from state to state. Per capita income or income per head the GROSS NATIONAL PRODUCT national income of a country divided by the size of its POPULATIONThis gives the average income per head of. Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will.

State and local income taxes are taken directly off of the W-2. Consider talking to a financial advisor. Per Stirpes Distributions.

Per capita is a Latin phrase meaning by head Its used to determine the average per person in a given measurement.

State Local Property Tax Collections Per Capita Tax Foundation

Information About Per Capita Taxes York Adams Tax Bureau

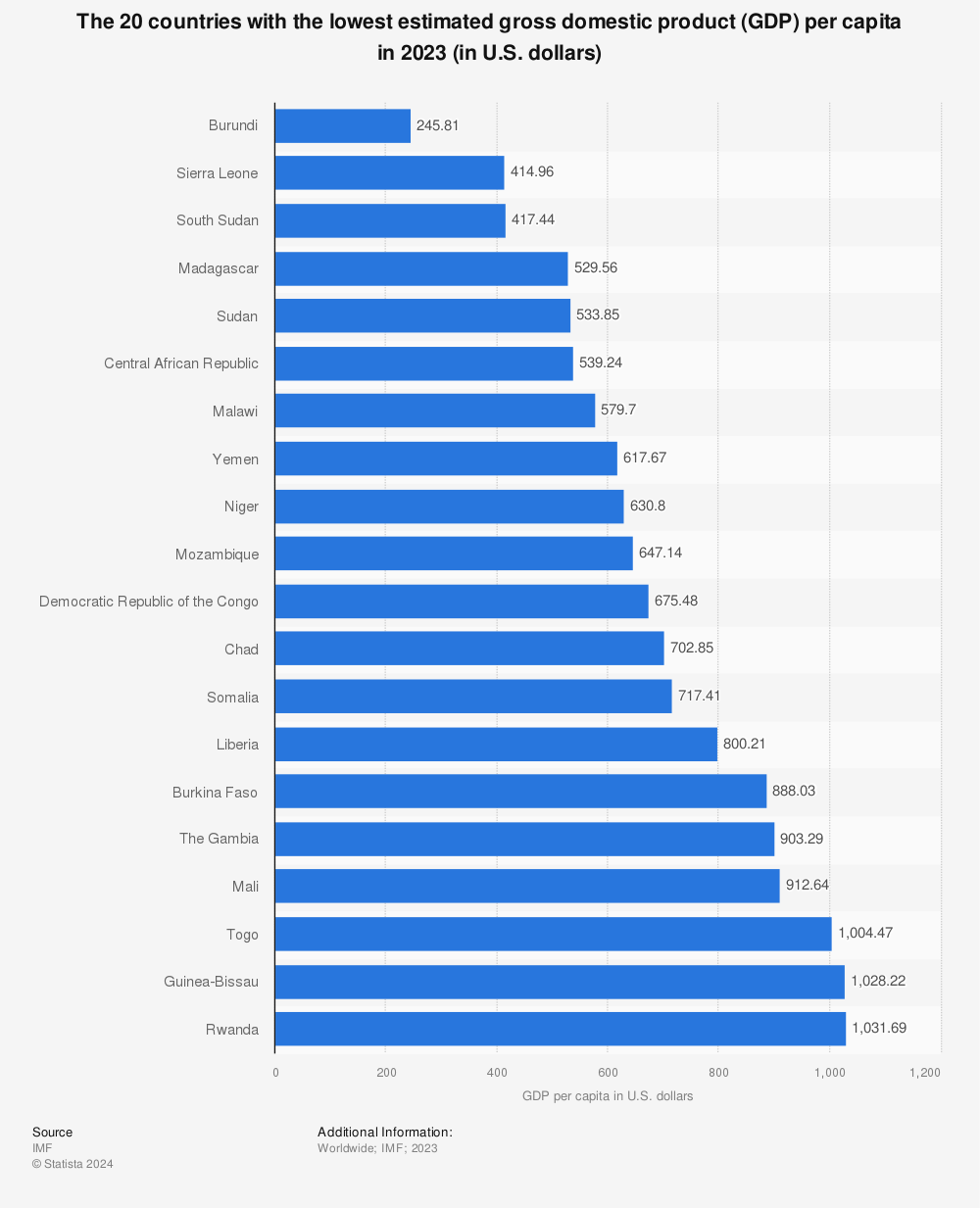

Top 20 Lowest Gdp Countries 2017 Statista

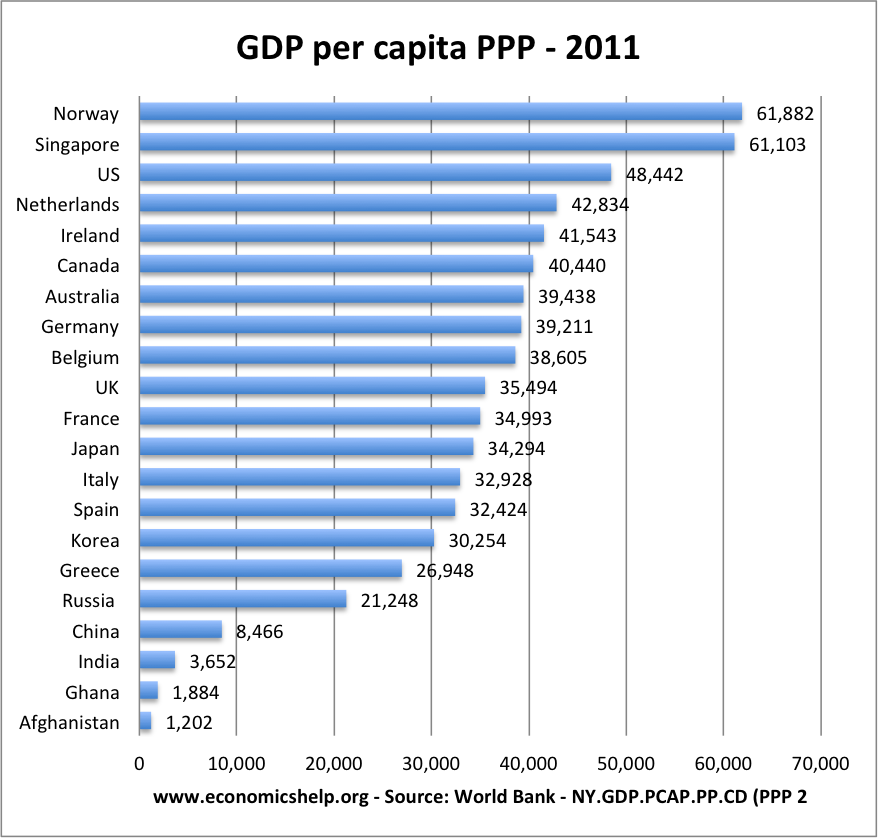

Real Gdp Per Capita Economics Help

What Does Per Capita Payroll Mean

Per Stirpes By Representation Per Capita What Do They Mean Russo Law Group

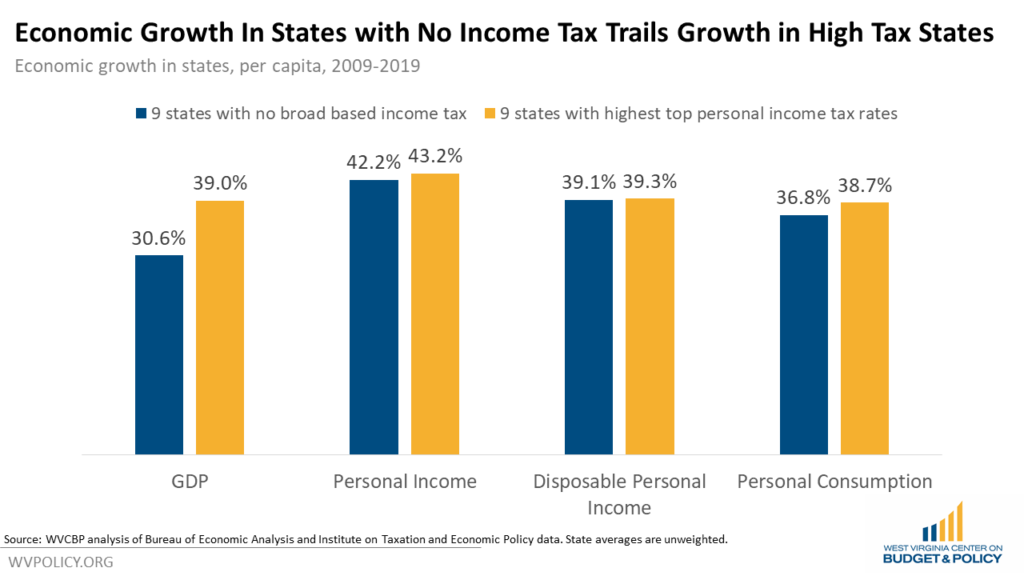

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy

Real Gdp Per Capita Economics Help

Property Tax Definition Learn About Property Taxes Taxedu

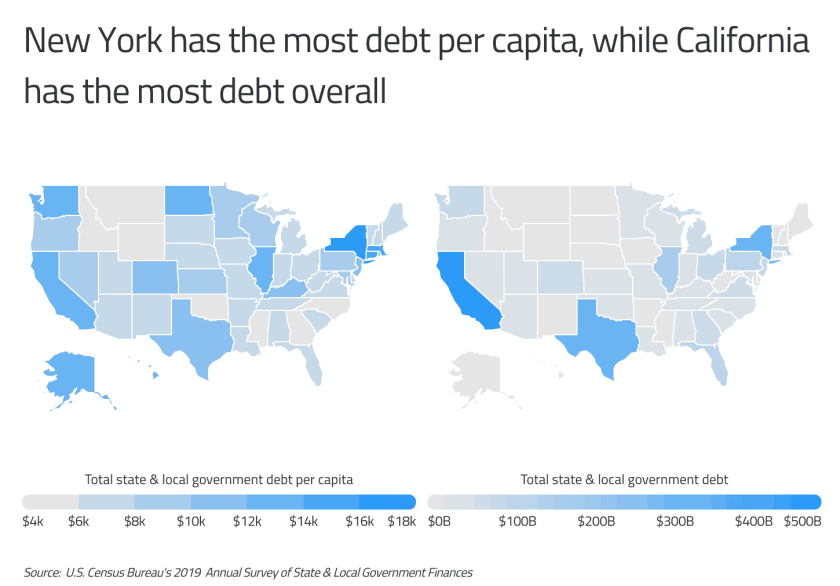

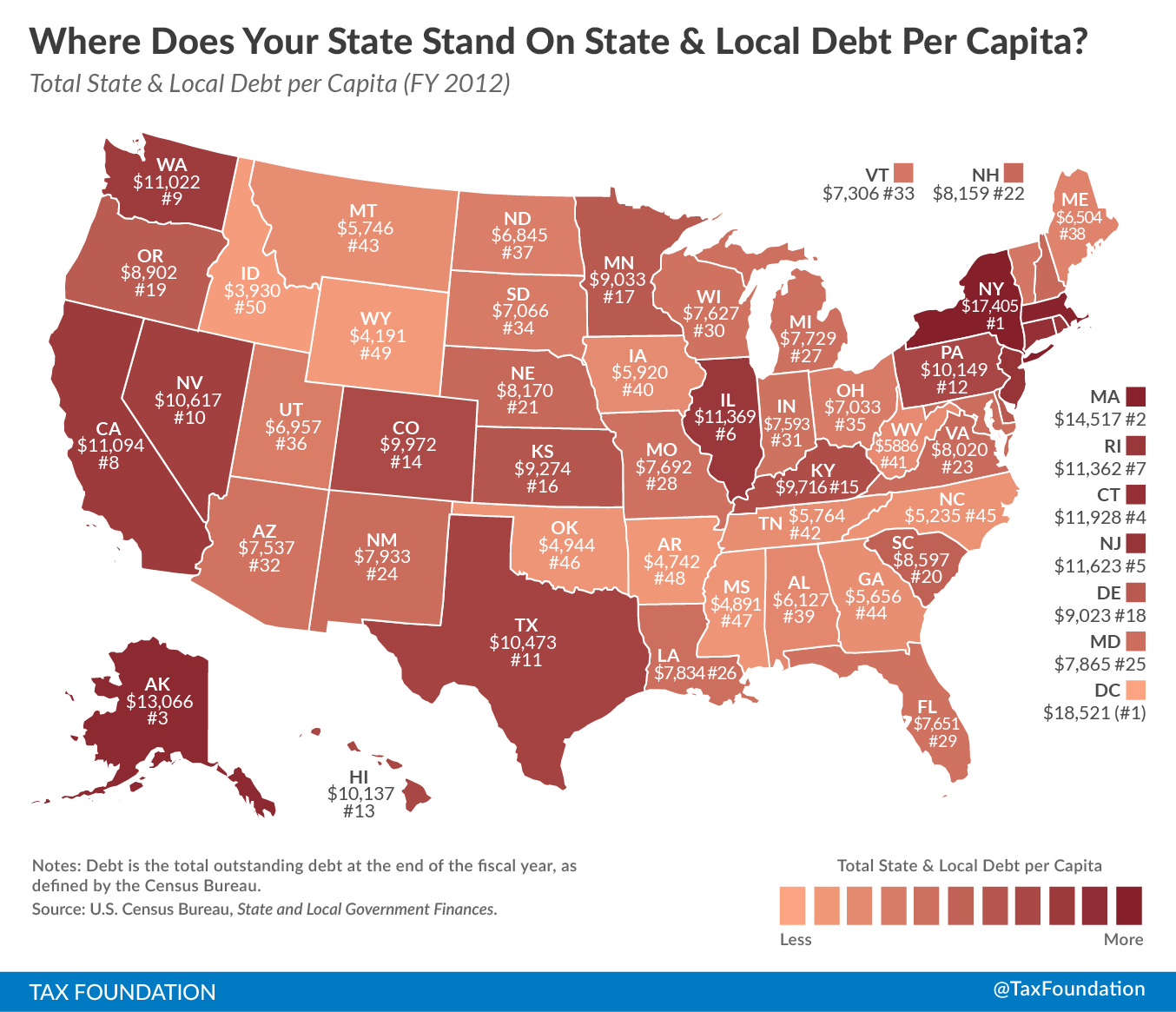

State And Local Governments With The Most Debt Per Capita

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Per Stirpes Vs Per Capita Death Benefit Policygenius

Brazil National Income Per Capita 2020 Statista

Why It Matters In Paying Taxes Doing Business World Bank Group

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)